Ease of implementation:

DexProtector is a no-code solution. It applies protections automatically to APKs, AABs, AARs, IPAs, Frameworks, and XCFrameworks. There’s no need for bitcode, awkward SDKs, or custom toolchains.

Licel solutions are used around the world to protect the mobile channel linking banks to the end users of their applications.

Our fraud prevention products are integrated automatically post-build into mobile apps on both major platforms; Android and iOS.

For more than a decade, this proven approach has helped our clients protect their applications against the fast-evolving threat of mobile banking fraud.

Licel provides you with all the tools you need to prevent account takeovers (ATO), mitigate authorised push payment fraud, prevent eKYC fraud, and stop automatic transfer system (ATS) malware, among other threats.

Our solutions to stop these threats include:

Our mobile app protection product, DexProtector, integrates modular solutions that are cryptographically bound to the host app. They are tamper proofed, and secured during runtime by the Licel vTEE and the DexProtector RASP Engine.

DexProtector comprehensively secures your mobile banking app via obfuscation, encryption, and RASP. The components it integrates prevent fraud, reverse engineering, tampering, IP and data theft, and API abuse.

At the protection stage, DexProtector injects its Runtime Engine and security modules.

And at the runtime stage, DexProtector’s integrated Runtime Engine and security modules protect your mobile banking app dynamically as it runs on users’ devices.

Licel security solutions are designed with developers and security teams in mind and exist to save you time and money.

Ease of implementation:

DexProtector is a no-code solution. It applies protections automatically to APKs, AABs, AARs, IPAs, Frameworks, and XCFrameworks. There’s no need for bitcode, awkward SDKs, or custom toolchains.

Ease of integration:

Whichever way you build your app, protection is just one simple step. Run DexProtector locally and offline, or integrate protection automatically in your Android Studio, Xcode, and CI/CD builds.

Stability and performance:

The DexProtector RASP engine is optimized for each platform, with native-level operations that run seamlessly in the background without affecting the user experience.

Account takeovers (ATO) happen when a fraudster gains unauthorized access to a user’s account. In mobile banking, this can happen via stolen credentials, malware, remote access tools, and inadequate authentication mechanisms.

How we stop account takeovers.

Licel solutions help banks to detect suspicious login attempts from new or untrustworthy devices:

Our products also prevent the theft of user credentials:

Mobile banking apps often carry out eKYC (electronic Know Your Customer) checks when onboarding new users to verify their identity. This can be done via digital documents, photos, videos, and biometric data.

Fraudsters will try to bypass or abuse this ID verification process, using stolen or counterfeit documents to open accounts, apply for loans, and obtain credit.

How we stop eKYC fraud.

Licel solutions help banks to:

An automatic transfer system (ATS) malware, installed on a user's device, can automatically perform unauthorized transfers and divert funds to accounts controlled by fraudsters.

ATS malware generally only becomes active after the user has already authenticated. And it can even hide transactions from the user. This makes it tricky to detect the fraudulent activity until significant damage has already been done.

How we stop automatic transfer system malware.

Banks are aware of the automatic transfer system threat, but often lack the tools to prevent it. That’s where Licel’s advanced anti-malware capabilities can offer vital reinforcement:

Authorized Push Payment (APP) fraud involves manipulating users into authorizing payments themselves. In mobile banking, this can occur through social engineering, impersonation, and deceptive phone calls.

Fraudsters trick users into believing they are interacting with legitimate entities or individuals, convincing them to initiate transactions or even provide remote access to their devices.

How we stop authorized push payment fraud.

Licel solutions help banks to:

Stop cybercriminals from exploiting screen sharing and remote access:

Attacks targeting mobile banking applications are becoming multi-layered. Take this example from a bank in the Middle East:

This real-world example of a sophisticated cloning attack emphasizes the need for equally-sophisticated mobile banking protection. A combination of Device ID, integrity control, threat monitoring, and SSL Pinning would have stopped this attack from succeeding.

DexProtector is a no-code security solution for Android and iOS applications, SDKs, and libraries. Its core mechanisms include anti-tampering, anti-reverse engineering, and network security.

Its anti-malware capabilities, UI protection, API protection, and authenticator functionality represent the cutting-edge of mobile banking protection.

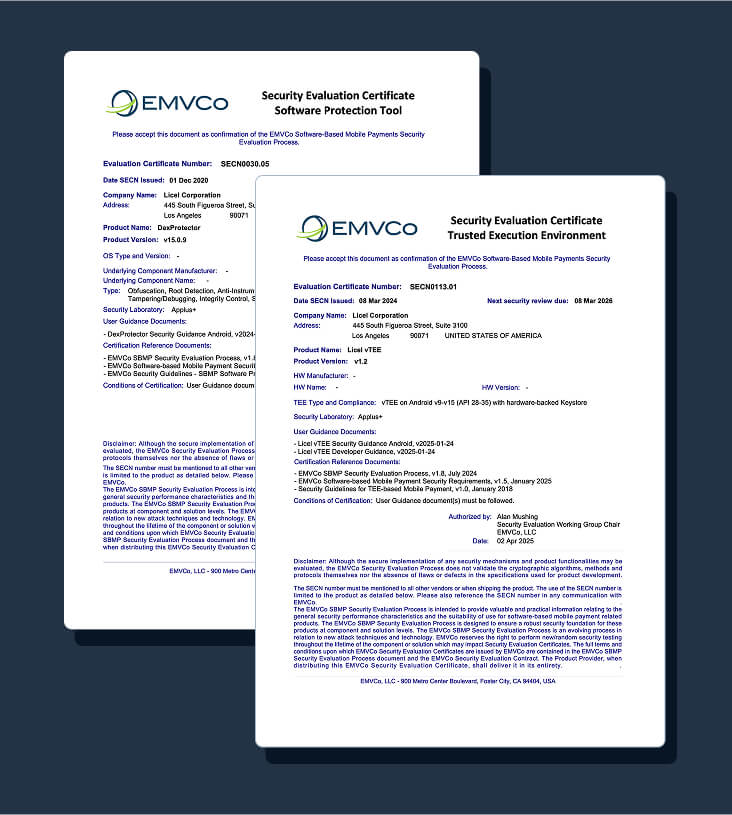

DexProtector provides the core security foundations needed to maintain integrity and prevent the most sophisticated threats facing mobile banking applications. It has been evaluated and approved as a software protection tool by EMVCo for six consecutive years.

Alice is a threat intelligence, monitoring, and attestation solution that shares incident reports for DexProtected applications.

Its data about the threats facing your app and the wider industry helps you to bridge the gap between vigilance and action. Alice empowers you to strengthen your security posture both now and in the near future.

Alice not only helps you to identify malicious threats facing your mobile banking application. It also forms a key part of our Anti-Malware Module, enabling you to configure app protection actions based on the severity of the threat.

Licel’s Anti-Malware Module is leading the fight against the persistent malware threat.

Leveraging both DexProtector and Alice Threat Intelligence, the Anti-Malware Module provides apps with integrated malware and Potentially Harmful App detection capabilities. This includes checks for known malware signatures, and heuristic checks which flag indicators of potential interference by malware or PHAs.

The core malware database is maintained by Licel’s security research team. It can be customized according to your requirements, and it delivers instant over-the-air (OTA) updates to secure both end users and apps from the latest threats.

Our UI Protection Module also mitigates the malware threat. It stops screen capture (screenshots, screen sharing, and screen recording), protecting IP and reducing the threat of remote access fraud.

The Licel Virtual Trusted Execution Environment (vTEE) enables trusted applications to carry out sensitive transactions and operations. It is making innovative banking and payment processes much more seamless and secure.

The vTEE provides a safe storage space for banking credentials, keys, and tokens, as well as software-based cryptographic mechanisms and device binding to link bank accounts to specific devices.

More agile than traditional TEEs, it can be updated in a fraction of the time it takes for a hardware equivalent to get back up and running.

The Licel vTEE has been evaluated and approved by EMVCo under the SBMP TEE category.

The EMVCo-approved Licel vTEE implements trusted applications (TA) that provide advanced security modules to protect mobile banking apps against sophisticated threats.

Automatically protects app cryptographic operations and keys via vTEE isolation, white-box cryptography, and device binding.

Time-Based One-Time Password (TOTP) generator to enhance Multi-Factor Authentication (MFA).

EMVCo is a global technical body responsible for the secure integration of card-based payment products worldwide. It is collectively owned by industry giants such as American Express, Discover, JCB, Mastercard, UnionPay, and Visa.

DexProtector was the first software protection solution to be SBMP evaluated by EMVCo for both Android and iOS. It has been approved for five consecutive years.

Our Licel vTEE is currently the only virtual trusted execution environment listed with EMVCo SBMP TEE approval.

Both of these solutions are helping to enable and accelerate innovation in the mobile banking and finance industry.